The Underappreciated Value Of News Corp: A Detailed Investment Analysis

Table of Contents

News Corp's Diversified Portfolio: A Key Strength

News Corp's success stems from its remarkably diversified portfolio, a crucial strength that mitigates risk and provides multiple avenues for revenue generation. This diversification across various media segments contributes to a resilient and adaptable business model.

Robust Media Holdings: A Foundation of Strength

News Corp boasts a collection of influential media assets, contributing significantly to its diverse revenue streams. This portfolio includes:

- The Wall Street Journal: A globally recognized financial newspaper, providing substantial subscription revenue and a powerful brand presence. Its digital subscription model is particularly noteworthy.

- HarperCollins Publishers: A major player in the book publishing industry, with a vast catalog of titles and a strong presence in both print and digital formats. This division contributes a stable revenue stream less susceptible to daily market fluctuations.

- Realtor.com: A leading online real estate platform, capitalizing on the booming digital real estate market and generating significant advertising and subscription revenue. This digital asset represents a key growth area for News Corp.

- News Corp newspapers: A network of influential newspapers across various regions, providing local news and advertising opportunities. While print circulation faces challenges, News Corp's digital strategy is mitigating these risks.

This diversified portfolio of media holdings provides strong and diverse revenue streams, making News Corp less vulnerable to market downturns affecting specific sectors.

Strategic Acquisitions and Growth Opportunities: Fueling Future Growth

News Corp's history demonstrates a willingness to engage in strategic acquisitions to expand its reach and capabilities. Past successful acquisitions have broadened its portfolio and enhanced its market position. Future growth opportunities may lie in:

- Further expansion into the digital media landscape: Investing in emerging technologies and digital platforms.

- Strategic partnerships: Collaborating with other media companies to leverage synergies and expand market reach.

- Acquisitions in complementary sectors: Expanding into adjacent markets to diversify further and capture new revenue streams.

Financial Performance and Valuation Metrics: A Deep Dive

Analyzing News Corp's financial performance offers valuable insights into its valuation and investment potential. Examining key financial indicators provides a clearer picture of its financial health and future prospects.

Analyzing Key Financial Indicators: A Quantitative Assessment

Reviewing News Corp’s financial statements reveals several key data points: (Note: Specific data would be included here, ideally with charts and graphs showing revenue growth, profit margins, debt levels, and free cash flow over a specified period. This data would need to be sourced from publicly available financial reports.)

- Revenue Growth: [Insert Data and Analysis Here]

- Profitability: [Insert Data and Analysis Here]

- Debt Levels: [Insert Data and Analysis Here]

- Free Cash Flow: [Insert Data and Analysis Here]

This analysis would provide a strong quantitative basis for the valuation assessment.

Comparing Valuation to Peers: Relative Value Assessment

Comparing News Corp's valuation multiples (P/E ratio, Price-to-Book, etc.) to its peers in the media and publishing industries is crucial for determining its relative attractiveness as an investment. (Note: Again, specific data from comparable companies would be included here, showing News Corp's valuation multiples relative to its competitors. This comparison will highlight whether News Corp is trading at a discount or premium to its peers).

- P/E Ratio Comparison: [Insert Data and Analysis Here]

- Price-to-Book Ratio Comparison: [Insert Data and Analysis Here]

- Market Capitalization Comparison: [Insert Data and Analysis Here]

This comparative analysis will help determine whether the News Corp stock is currently undervalued in the market.

Risk Factors and Potential Downsides: Navigating Challenges

While News Corp offers significant investment potential, it's essential to acknowledge the challenges and risks inherent in the media industry.

Industry Challenges: Navigating the Shifting Landscape

The media industry faces significant headwinds:

- Declining print readership: The shift to digital media presents a persistent challenge for print publications.

- Competition from digital platforms: News Corp faces intense competition from other digital media companies.

- Advertising revenue fluctuations: Advertising revenue can be volatile and susceptible to economic downturns.

News Corp's strategic investment in digital properties aims to mitigate these risks, but they remain important considerations.

Geopolitical Risks: External Factors to Consider

Geopolitical events can impact News Corp's operations:

- Regulatory changes: Changes in media regulations can significantly affect operations in various markets.

- Political instability in key markets: Political instability in regions where News Corp operates can disrupt operations and affect revenue.

Understanding these geopolitical risks is critical for a comprehensive investment analysis.

Investment Strategy and Outlook: A Long-Term Perspective

Based on the analysis presented, News Corp's long-term growth potential appears promising.

Long-Term Growth Potential: Reasons for Optimism

Several factors support a positive outlook for News Corp:

- Its diversified portfolio provides resilience against sector-specific challenges.

- Strategic investments in digital platforms position it for growth in the digital media landscape.

- Strong brand recognition and established market positions provide a solid foundation.

These factors indicate that News Corp is well-positioned for long-term growth.

Recommendation: A Considered Opinion

Considering the factors analyzed, including News Corp's diversified portfolio, relatively strong financial performance, and potential for future growth, [Insert Recommendation Here – Buy, Sell, or Hold]. The recommendation is primarily based on [Insert Justification Here – e.g., its undervalued valuation compared to peers, its strong digital growth strategy, etc.].

Conclusion: Unlocking the Underappreciated Value of News Corp

This analysis highlights News Corp's often-overlooked potential as an investment. Despite industry challenges, its diversified portfolio, strategic acquisitions, and strong financial fundamentals suggest an undervalued stock. Its commitment to digital expansion further strengthens its long-term growth prospects. With its diversified portfolio, strong financial fundamentals, and significant growth potential, News Corp presents a compelling investment opportunity. Conduct your own thorough due diligence and consider adding News Corp stock to your portfolio today. Understanding the nuances of News Corp's valuation is key to making an informed investment decision.

Featured Posts

-

Kyle And Teddis Heated Confrontation A Dog Walker Dispute

May 25, 2025

Kyle And Teddis Heated Confrontation A Dog Walker Dispute

May 25, 2025 -

Strong Pmi Data Supports Dow Jones Continued Cautious Upward Trend

May 25, 2025

Strong Pmi Data Supports Dow Jones Continued Cautious Upward Trend

May 25, 2025 -

Pomnite Li Konchita Vurst Transformatsiyata Na Pobeditelkata Ot Evroviziya

May 25, 2025

Pomnite Li Konchita Vurst Transformatsiyata Na Pobeditelkata Ot Evroviziya

May 25, 2025 -

Czy Porsche Cayenne Gts Coupe To Idealny Suv Test I Recenzja

May 25, 2025

Czy Porsche Cayenne Gts Coupe To Idealny Suv Test I Recenzja

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav And Its Significance

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav And Its Significance

May 25, 2025

Latest Posts

-

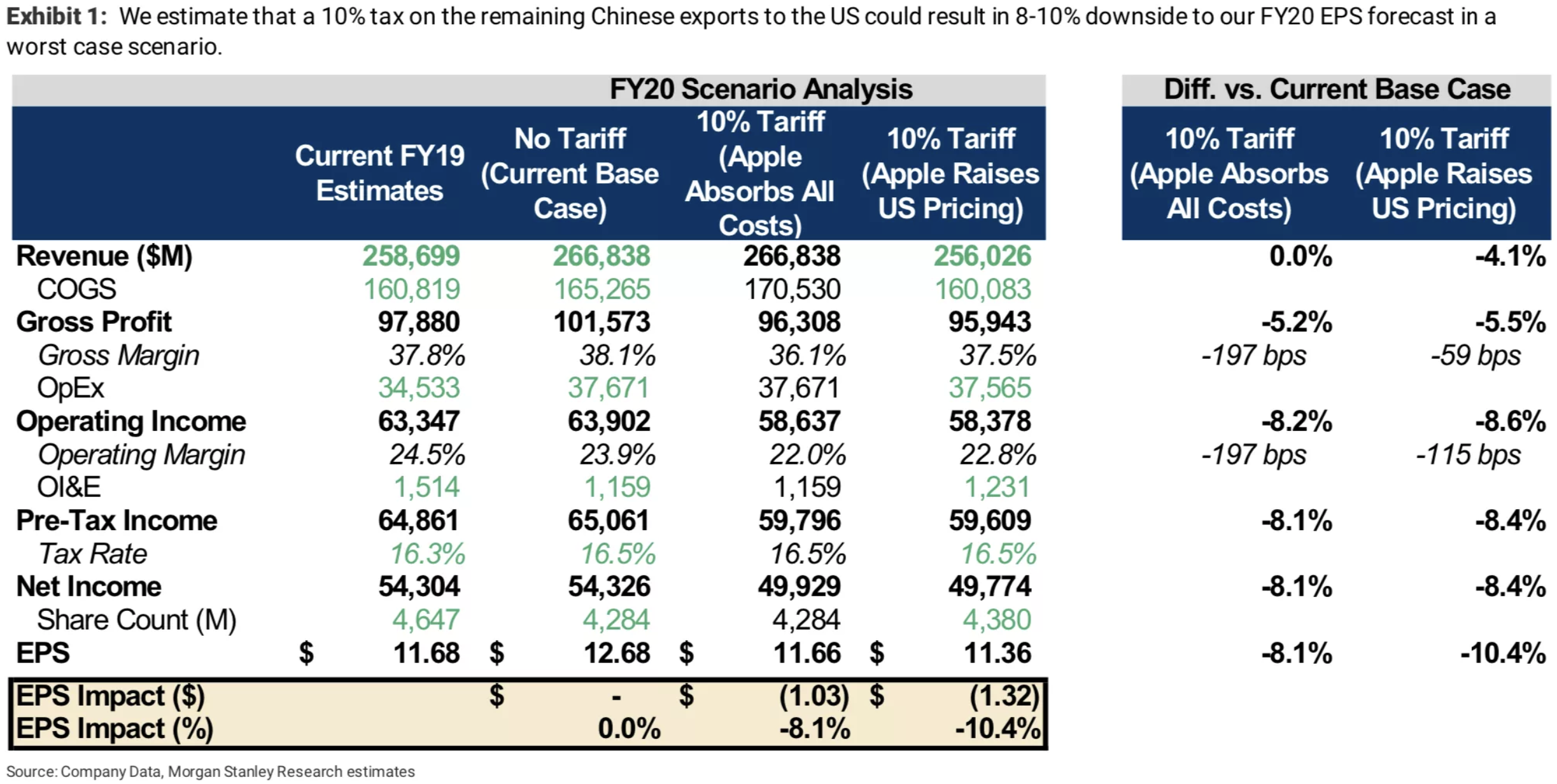

Apple Stock Takes A Hit From Projected 900 Million Tariff

May 25, 2025

Apple Stock Takes A Hit From Projected 900 Million Tariff

May 25, 2025 -

Apple Stock Slumps 900 Million Tariff Impact

May 25, 2025

Apple Stock Slumps 900 Million Tariff Impact

May 25, 2025 -

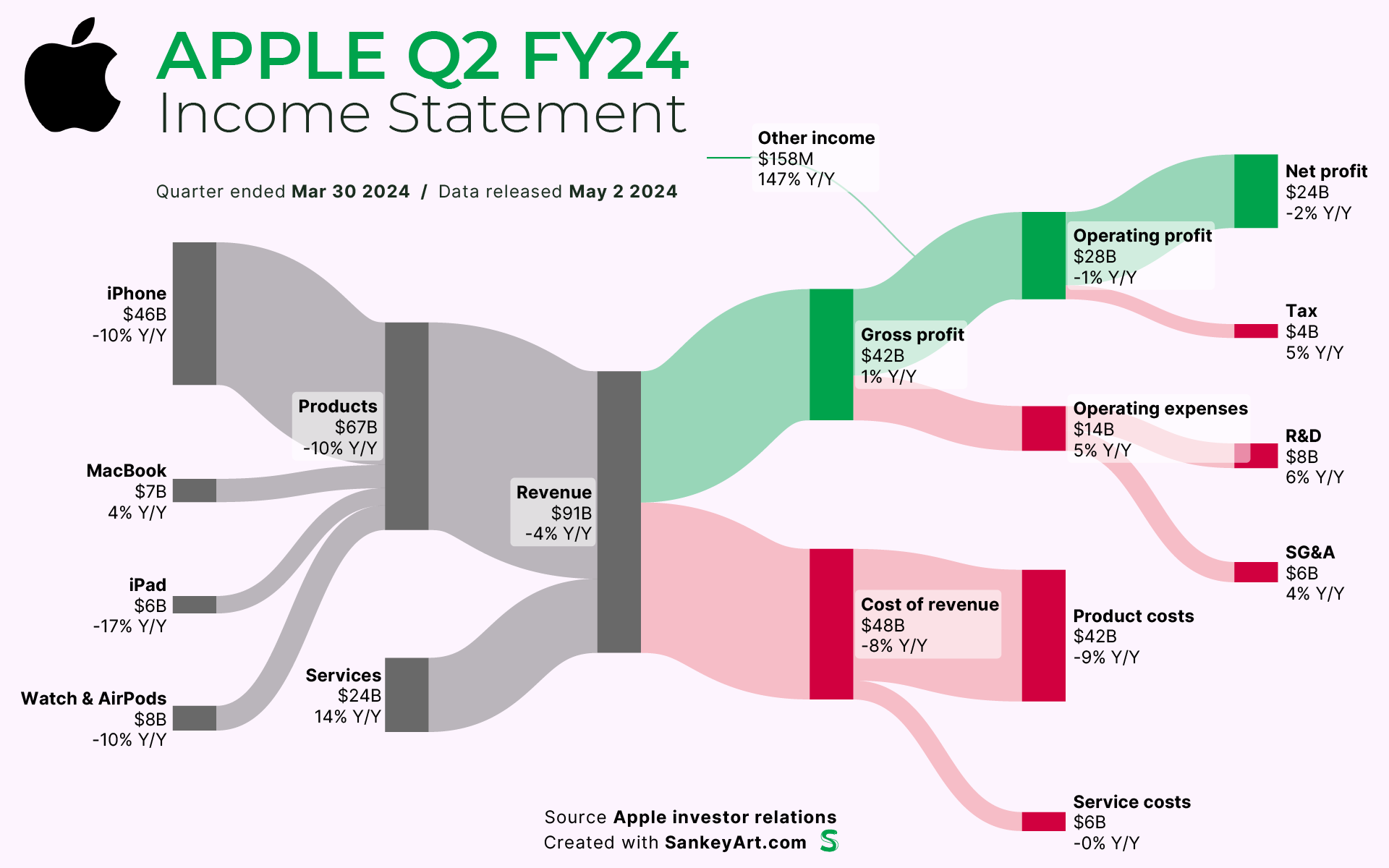

Is Apple Stock A Buy After Strong Q2 Earnings

May 25, 2025

Is Apple Stock A Buy After Strong Q2 Earnings

May 25, 2025 -

Apple Stock Analysis Of Q2 Results And Future Predictions

May 25, 2025

Apple Stock Analysis Of Q2 Results And Future Predictions

May 25, 2025 -

Apple Stock Q2 Earnings I Phone Sales And Investor Outlook

May 25, 2025

Apple Stock Q2 Earnings I Phone Sales And Investor Outlook

May 25, 2025